Two major U.S. banks — Silicon Valley Bank and Signature Bank — closed in March 2023. But while these shut downs came as a shock to the general public, there is some positive news for the average bank account holder: Over the last two years, banking has shifted to favor the depositor. Not only have the amount of banking fees dropped, but consumers’ interest earnings have risen dramatically — with interest rates seeing particularly notable increases in the third and fourth quarter of 2022.

For this study, we looked at Federal Deposit Insurance Corp. (FDIC) data to determine how banking fees and interest earnings changed between 2021 and 2022. Here’s what we found.

Key findings

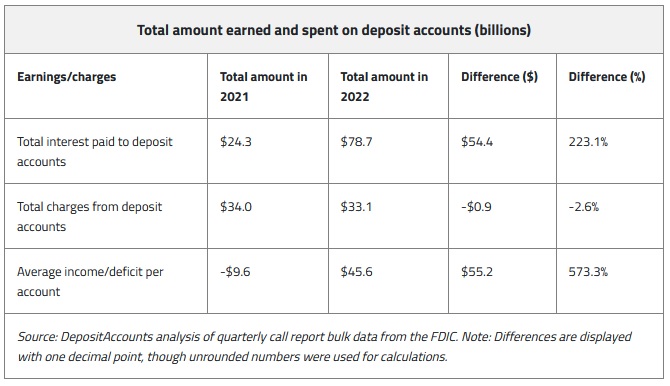

- Banks paid out $78.7 billion to domestic deposit accounts in 2022, according to our analysis of quarterly Federal Deposit Insurance Corp. (FDIC) filings. This contrasts sharply with the $24.3 billion paid out in 2021, for a year-over-year increase of 223%.

- Banks collected $33.1 billion in fees on these same accounts in 2022, down from $34.0 billion in 2021, a drop of 2.6%. Combined, this represented a net gain for depositors of $45.6 billion in 2022, compared to a net loss of $9.6 billion in 2021.

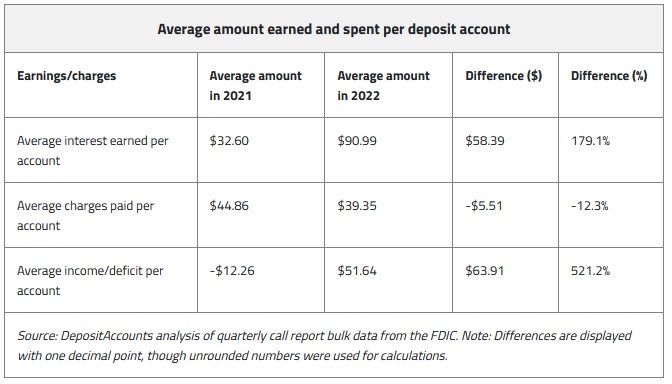

- This translates to average interest earnings of $90.99 per deposit account in 2022, compared to $32.60 in 2021, a gain of 179% for depositors. Deposit accounts include demand deposit accounts, such as checking accounts; savings deposit accounts; time deposits, such as certificates of deposit; and certain retirement savings accounts.

- Meanwhile, the typical account was charged $39.35 in bank fees in 2022, down 12% from $44.86 in 2021. Overall, this left depositors with a surplus of $51.64, compared with a deficit of $12.26 a year earlier.

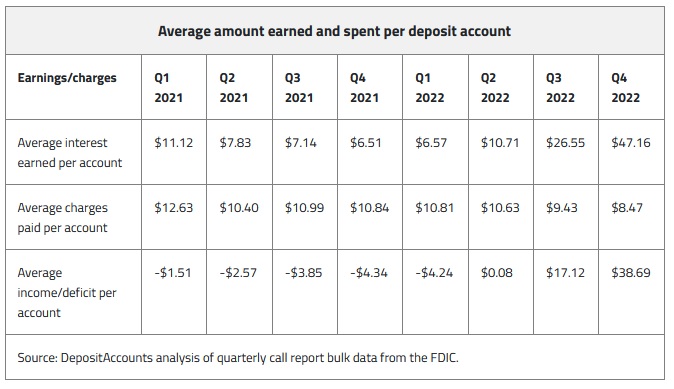

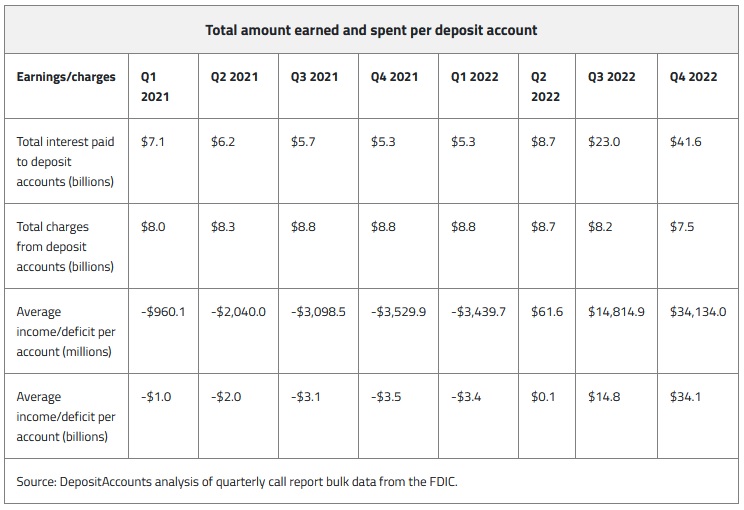

- Looking at the quarterly progression, the average account basically broke even in the second quarter of 2022, earning an average of $10.71 that quarter in interest while paying $10.63 in fees. By the fourth quarter of 2022, the accounts earned an average of $47.16 in interest and only paid $8.47 in bank charges.

- In fact, banks paid out $23.0 billion and $41.6 billion in interest on deposit accounts in the third and fourth quarters of 2022, respectively. This compares to a total payout of $38.4 billion in the preceding six quarters combined.

- Banks also ended 2022 with 882.3 million individual deposit accounts, an increase of 68.1 million (8.4%) compared to the end of 2021.

Banks paid out 223% more in 2022 than 2021

Money talks, and in 2022, banks had a lot to say. In fact, they paid out a whopping $78.7 billion in interest to domestic deposit accounts, a stark contrast to the mere $24.3 billion they paid out the year prior. That's a staggering year-over-year increase of 223%.

What's driving this surge in payouts? According to DepositAccounts founder Ken Tumin, rising interest rates are largely to blame here.

“The Fed increased its benchmark rate in 2022 at the fastest pace in decades,” he says. “Even though banks were slow to pass on these rate increases to their deposit accounts, over the past year, consumers were still able to see a widespread positive impact on deposit rates.”

What’s also clear is that banks are ramping up their efforts to attract and retain customers — especially with deposit accounts (which include checking accounts, savings accounts, certificates of deposit (CDs) and certain retirement savings). One way they’re doing so is by charging less in fees: In 2022, banks collected $33.1 billion in fees from domestic deposit accounts, a decrease of 2.6% from the $34.0 billion collected in the previous year.

According to Tumin, overdraft fees — which make up the bulk of fees that depositors pay — are likely the single largest contributor to this drop. That’s because in the last year, many banks either revised their overdraft fee policies to be more consumer-friendly or eliminated those fees altogether.

When you add it all up, depositors walked away with a net gain of $45.6 billion in 2022, a stark contrast to the net loss of $9.6 billion in 2021.

For consumers, that means a 179% increase in average interest earnings

What does that mean for the average depositor, though? More green. The average interest earnings per deposit account were $90.99, a massive 179% increase from the previous year's average of $32.60.

This surge in interest earnings tells just one part of the story, as bank fees were down too: The typical deposit account was charged $39.35 in bank fees in 2022, down 12% from $44.86 in 2021. Overall, these increasing earnings and decreasing fees left depositors with a surplus of $51.64 — that compares with a deficit of $12.26 a year earlier.

Here’s how much the average account earned per quarter in 2022

While the year-over-year findings for depositors looks good, let’s break that down by quarter.

The first quarter of 2022 — when interest rates were still hovering around zero — showed a loss for depositors, with accounts earning an average of $6.57 and paying $10.81 in fees. In the second quarter of 2022, deposit accounts merely broke even, with an average earning of $10.71 and paying $10.63 in fees. The Fed had just begun hiking interest rates, setting a target of 1.50% to 1.75% in June.

Things started turning around by the third quarter, when the Fed grew aggressive with its interest rate hikes (targeting a federal fund rate of 3.00% to 3.25% by the end of the quarter). Between average earnings of $26.55 and average fees of $9.43, accounts saw a net $17.12 gain.

The fourth quarter of 2022 saw a significant improvement, with accounts earning an average of $47.16 in interest and only paying $8.47 in bank charges. At this point, the federal fund rate target had been hiked up to 4.25% to 4.50%.

That means by the latter half of 2022, banks paid out a total of $64.6 billion in interest on deposit accounts, surpassing the total $38.4 billion in the preceding six quarters combined.

These soaring earnings appear to have inspired more consumers to put their cash to use: Banks ended 2022 with 882.3 million individual deposit accounts — an 8.4% increase from the 68.1 million individual deposit accounts in 2021.

“The rise of deposit interest rates in 2022 probably sparked many consumers to open new savings accounts and CDs,” Tumin says. “Also, online banks have made account opening easy. There’s no need to close existing accounts. You can open a new high-yield online savings account and keep an existing checking account.”

Making the most of high interest rates: Expert tips

Depositors may be winning right now, but it won’t be that way forever — so it’s important to take advantage of these high rates and low fees while they’re still around. In particular, Tumin offers the following advice:

Open an online savings account if you haven’t done so already. “You can keep your existing checking and savings accounts at your current bank,” he says. “Simply open an online savings account and link it to your existing checking account. Once the link is established, it’s easy to electronically move funds back and forth to take advantage of the higher interest rates of the online savings account.”

Consider opening an online savings account at an online bank that also offers a free checking account. “After you become comfortable with the online savings account, you might want to think about also opening a checking account at the same bank,” he says. “You can then slowly make the online checking account your primary checking account, which can save you on potential checking account fees.”

If you want to keep most of your business with brick-and-mortar banks or credit unions, look for ones that offer high-yield reward checking. “These checking accounts offer a high yield up to a certain balance when monthly activity, such as debit card usage, is maintained,” he says. “The yields can be comparable to the top yields of online savings accounts.”

Methodology

Researchers calculated the aggregate amount of interest paid by Federal Deposit Insurance Corp.-insured banks on domestic deposit accounts, fees charged to deposit accounts and the total number of deposit accounts using quarterly call report bulk data from the FDIC.

Annualized numbers represent the sum of interest and fees in each quarter.