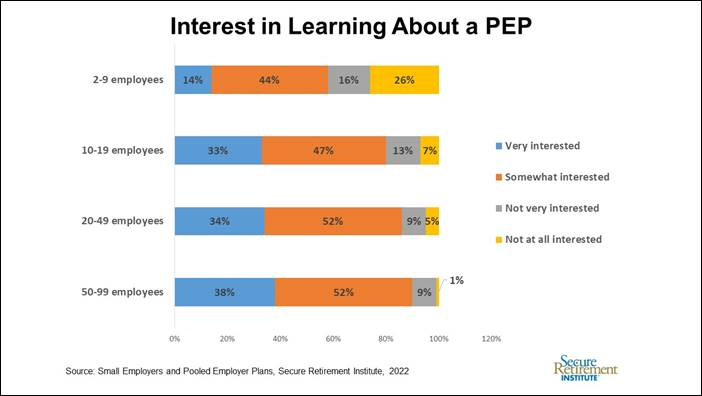

More than half of smaller employers surveyed by the Secure Retirement Institute (SRI)—regardless of whether there is a retirement plan currently in place—are interested in learning more about pooled employer plans, or PEPs.

A PEP is a 401(k) retirement plan that allows unrelated businesses to participate in one plan managed by a pooled plan provider (PPP). The PPP is the plan sponsor and fiduciary of the PEP and has discretion over plan administration and investments, which can reduce the costs, administrative burden and risks for participating companies.

Deb Dupont, assistant vice president, Worksite Retirement, SRI, notes this is a brand new market, with PEPs first approved for use in early 2021.

According to SRI research, small employers that are considering adding a defined contribution (DC) plan are interested in learning more about PEPs—but small employers with a current plan are also interested.

“While small employers without current retirement plans are interested in exploring PEPs, few expressed interest in adding them,” says Dupont.

Employers with 10 – 99 employees are significantly more interested in learning more about PEPs, especially the largest (small) employers, those with 50 – 99 employees.

Reasons for lack of interest in PEPS are relatively consistent across employer sizes up to 99 employees. Sixty- six percent of employers that have a retirement plan have no plans to make changes.

Support and Communications

Small employers that are avoiding switching to a PEP express concerns about lower levels of support for the company (42%) or lower levels of service for their employees (39%). Almost 4 in 10 small employers want to retain control of plan design decisions and an additional third of employers don’t think a PEP would reduce plan costs. A similar number of small employers cite wanting to retain control of vendor selection as the reason not to switch.

Most small employers that currently sponsor DC plans are open to the idea of discontinuing their existing plans in favor of joining a PEP.

The likelihood of trading an existing DC plan for a PEP grows with organization size among these smaller employers; more than 8 in 10 with 20 – 99 employees are at least somewhat likely to want to make the switch. It’s less common for very small employers to have a DC plan in the first place and, among those who do, there is strong reluctance to switch to a PEP.

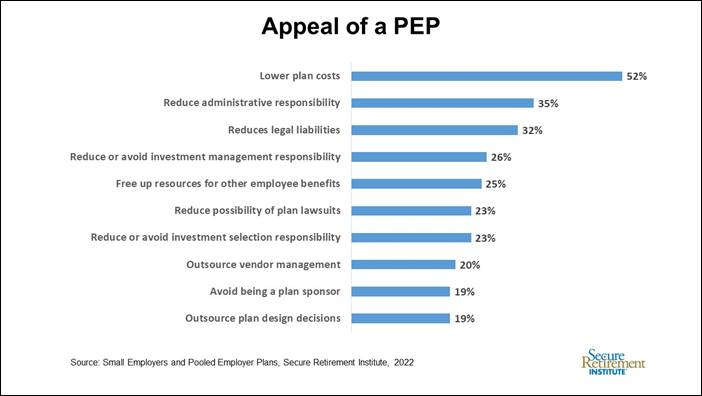

Lowering plan costs is the main reason an employer would choose to join a PEP (whether switch an existing plan or begin offering a plan with a PEP).

“Lower cost is the most compelling reason employers would choose a PEP, but other reasons may combine to create a powerful value proposition for this new construct,” says Dupont.

When it comes to awareness, fewer than half of small employers are even somewhat familiar with PEPs. The smallest employers are least likely to have near-term (within two years) plans to introduce a retirement savings plan.

“The attraction of a PEP is similar, whether employers currently do or do not have a DC plan in place. For both, cost is most compelling, but reducing administrative responsibilities also has a stronger appeal for employers that currently manage administrative responsibilities of an existing plan,” Dupont says.