“Will the pandemic finally kill cash?”

That was the question recently posed by The Washington Post as it reviewed numerous recent challenges consumers and businesses face with using cash. From a national shortage of coins to widespread bank branch closings to concerns that physical money might present additional risk for spreading the COVID-19, speculation has increased that the long-anticipated replacement of cash with digital currency may be closer to reality.

However, experts interviewed by Advisors Magazine believe cash will remain in use for the near future, with digital currency remaining a longer-term solution. The pandemic has accelerated trends away from cold hard cash to digital finance that were already well underway before COVID-19 struck in 2020. Still, most observers consider the pandemic only one among many factors contributing to the decline of physical cash.  One of the most obvious symptoms of the cash shortage is the signs that remain posted at many businesses specifying they will only accept exact change (or in some cases, no cash at all). This year’s shortage of coins has its roots in the current crisis.

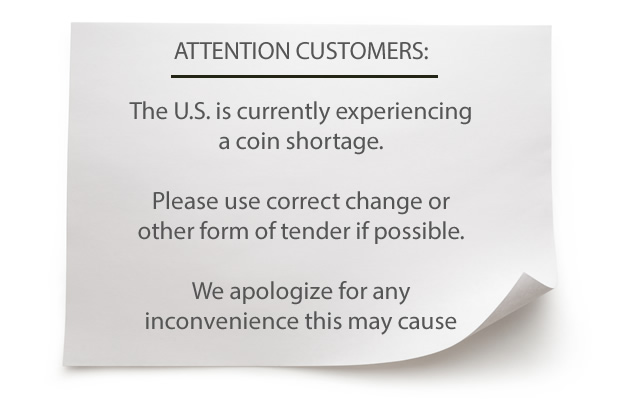

One of the most obvious symptoms of the cash shortage is the signs that remain posted at many businesses specifying they will only accept exact change (or in some cases, no cash at all). This year’s shortage of coins has its roots in the current crisis.

“Business and bank closures associated with the COVID-19 pandemic have significantly disrupted the supply chain and normal circulation patterns for U.S. coin,” the Federal Reserve stated in a June 30 announcement. “While there is an adequate overall amount of coins in the economy, the slowed pace of circulation has reduced available inventories in some areas of the country.”

To address the coin shortage, the Fed capped the number of coins it distributed to depository institutions. The cap led banks to limit the amount of change they would supply their customers. That, in turn, led many businesses to either stop taking cash or requiring exact change. In addition, the U.S. Mint also halted production of new coins for several weeks during the spring, although it returned to full production by mid-June. “The primary change as a result of the pandemic is the fact that we were staying at home and conducting more online transactions,” according to Ramnath Chellappa, associate dean and academic chair at Emory University’s Goizueta Business School, who is studying the trend. “The shortage is caused more by people are sitting on cash, which is not moving to the stores. The coin shortage is a function of less currency movement with the smaller businesses, which have suffered from a lack of access to banks. Small businesses are driving more of this than from consumers fundamentally changing their thinking.”

“The primary change as a result of the pandemic is the fact that we were staying at home and conducting more online transactions,” according to Ramnath Chellappa, associate dean and academic chair at Emory University’s Goizueta Business School, who is studying the trend. “The shortage is caused more by people are sitting on cash, which is not moving to the stores. The coin shortage is a function of less currency movement with the smaller businesses, which have suffered from a lack of access to banks. Small businesses are driving more of this than from consumers fundamentally changing their thinking.”

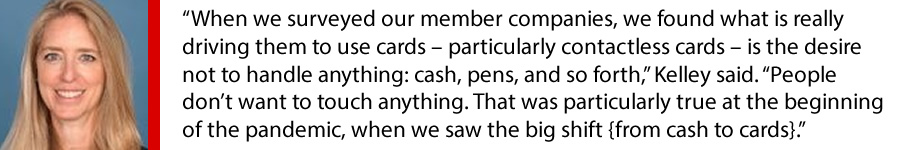

A survey of small and medium-sized businesses by payments consultants The Strawhecker Group and the trade group Electronic Transactions Association (ETA) found increased consumer use of credit and debit card since the COVID-19 pandemic began. The study also reported a 27 percent increase in the use of contactless payments (such as mobile phone apps such as Apple Pay, and contactless debit and cards) as the year progressed.

The coin shortage probably only has an incremental impact on the movement away from cash, according to Jodie Kelley, the CEO of ETA, which includes more than 500 companies in the payment processing industry. A more pressing issue is concern about handling physical money during the pandemic.

Another factor was the closing of many bank branches – some temporarily –during the early stages of the pandemic, which makes it more difficult for small businesses to continue normal banking activities. For example, financial technology platform Kabbage address the problem this summer by introducing a full-service business checking account designed specifically for small businesses. Features of the no-fee Kabbage Checking include cash deposits, free ATM access, and bill paying capabilities.

“Amidst one of the largest financial crises in history, we helped more than 225,000 small businesses access services many of their long-time bank partners would only provide to their largest customers,” stated Kathryn Petralia, president of Kabbage Inc., in a press release.

Kelley said issues like fewer branches, a shortage of coins, and the need to securely deposit cash at a bank also discourage businesses from accepting cash, continuing a trend that began several years ago.

“Anything that makes cash harder is going to make other alternatives more attractive,” Kelley added. “If you can get the same transaction done without anyone having to touch anything other than your own phone or your own card, it works on both sides of the transaction.”

Once the current crisis ends, Kelley said she believes more people will continue choosing digital alternatives to pay for in-person purchases, shop online, and transfer money to friends and family. She expects more consumers will favor electronic alternatives now that they have experienced how much easier non-cash transactions have become.

“I think the pandemic is going to play a role,” Chellappa added. “But I don’t think we are going to see that big of a cultural change as a result of the pandemic.”

Chellappa said he believes some consumers and businesses will go back to cash when the current obstacles are resolved. Many other countries in Europe, Asia, and Africa have embraced digital cash at higher rates than has occurred in the United States, he noted. Some Americans are more comfortable with cash than with electronic method, which create a permanent record of how they spend their money.

“My understanding is that many of those folks who believed in using coins and physical cash will revert back to that once the economy opens up,” he added.

The desire for autonomous activity could also hamper development of a government-backed digital currency, which has drawn renewed global attention during the current financial downturn. China is currently exploring setting up a digital fiat currency along the lines of cybercurrencies such as Bitcoin. The Federal Reserve is also in the early stages of exploring a U.S. digital currency.

However, Chellappa said, he expects the government itself will be the main obstacle to adopting a fiat currency in the United States.

“Financial transactions have been tied to a physical instrument, such as a credit card or a bank account,” he said. “Digital cash or digital currency has the ability to be anonymous. The government essentially would not allow for many of these things to happen if they cannot have oversight. I would say the government does not want purely digital transactions that can be anonymized.”

Kelley agreed that conversations about digital currencies are still in the early stages and will probably continue for some time. But whether the ultimate result is a government-issued digital currency or increased use of moving money through electronic means, she added, current trends towards digital commerce will continue to accelerate.

A recent Federal Reserve study of non-cash payment trends in the United States stated, “The number of core noncash payments, comprising debit card, credit card, ACH {automated clearing house}, and check payments, reached 174.2 billion in 2018, an increase of 30.6 billion from 2015. The value of these payments totaled $97.04 trillion in 2018, an increase of $10.25 trillion from 2015.”

While credit, debit, and ACH payments grew over the three-year period, the Fed added, the number physical checks fell by 7.2 percent to 14.5 billion, and the value of those checks declined by four percent. ATM cash withdrawals also fell from 6 billion in 2012 to 5.1 billion in 2018 -- another sign that cash was declining in popularity even before 2020.

“There was already a trend in this space before the pandemic that was occurring as a result of technology driving innovation,” Kelley said. “One was towards more credit and debit card use; another was towards contactless payments. As consumers try technology and like it, they want more of it. I think those two trends are going to endure once people realize how easy it makes their lives. We are definitely seeing that kind of cycle in payments already.”

Chellappa also pointed to increase usage of online payment systems, and of cash transfer apps such as PayPal and Venmo, as signs the United States is beginning to catch up with other countries. In Africa, for example, many people do not have bank accounts or Social Security numbers, but they do have cell phones, he said. They use mobile apps to transfer money and their phone number becomes their personal ID number.

Security is no longer a significant issue with many types of digital payments, he added. One of the major changes accompanying e-commerce was moving liability for fraudulent or erroneous transactions from the consumer to the merchant. Chellappa added e-commerce is actually safer than using a physical card, as cybercriminals install skimmers on ATMs or gas station card readers that capture PINs and card numbers.

The growth in non-bank platforms for electronic payments and fund transfers is also leading more banks to introduce similar products, further speeding the shift from physical to digital money.

“I think the banks finally understood that they need to provide this kind of platform,” Chellappa said. “All these mechanisms could have been provided by the banks a long time ago. They have already been developed and used in other countries. Now the banks are revisiting those digital products and services.”