The subtle yet important differences

A significant part of financial literacy is knowing which professional to call in various situations. On the surface, many financial professionals seem to have similar duties. The fiduciary, the broker, and the dual registered advisor serve vastly different purposes, but they are seen as overlapping disciplines to many people outside of the industry. Advisors Magazine asked advisors across the industry in different disciplines for their reasoning – why don’t prospective investors know the subtle yet important differences between different types of financial professionals, especially with $74.3 trillion under management globally according to the figures from the Boston Consulting Group.[1]

Many prospective investors focus their educational efforts solely on the money being used in transactions and not the people handling it. The fiduciary, the broker and the dual registered advisor all treat the same pile of money differently, which ensures three different outcomes. Which is the best for the investor? Some financial professionals may also be guilty of taking advantage of investor naivete concerning the nature of the relationship between advisor and investor. In short, fiduciaries, brokers and dual registered advisors have different levels of responsibility to the investor – a distinction that can make a huge difference in the way that an investor’s money is utilized. When the investment methodology of the financial manager does not match the wishes or philosophy of the investor, the results are usually underwhelming from the client’s perspective.

“Most clients don’t know the difference and don’t know to ask,” says Michael Walsh of Walsh & Associates. “We have been a Registered Investment Advisor since 1986, and we struggle to explain this distinction to this day. If we bring it up to a client without their asking, the look on their face says, ‘Why are you telling me this?’ Most clients mistakenly assume that every advisor acts in their clients’ best interests.”

The first step in choosing the best financial advisor is to understand the responsibility that different types of advisors have to a client’s well-being. The Registered Investment Advisor (RIA), or fiduciary, has a fundamental (read: legal) responsibility to act in the best interests of a client. The broker, also known as a non-fiduciary, does not. The dual registered advisor is registered as both a fiduciary and non-fiduciary. This kind of advisor can offer financial advice like a fiduciary and sell investment products with a direct benefit of an incentive such as a commission like a non-fiduciary.

The first step in choosing the best financial advisor is to understand the responsibility that different types of advisors have to a client’s well-being. The Registered Investment Advisor (RIA), or fiduciary, has a fundamental (read: legal) responsibility to act in the best interests of a client. The broker, also known as a non-fiduciary, does not. The dual registered advisor is registered as both a fiduciary and non-fiduciary. This kind of advisor can offer financial advice like a fiduciary and sell investment products with a direct benefit of an incentive such as a commission like a non-fiduciary.

“It comes down to communication,” Darian Andreson, president of the Senior Tax Advisory Group tells us. “The number one reason the investor/advisor relationship fails is due to the lack of communication from the advisor to the client. However, there are no requirements for a dual registered advisor to advertise what they do. Broker-dealers require signage in their advisor’s office, but that doesn’t explain what they do – only who they work with. I believe the advisors practice has to be more transparent today than ever before, because of advisors’ untimely communication in the past with clients.”

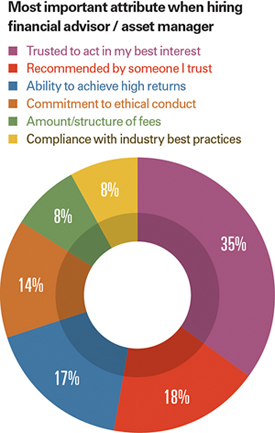

The Qualtrics Financial Advisor Client Experience Report lists “trust” as the number one reason that clients choose an advisor, outpacing even the need to have a “good investment track record.” A high degree of trust leads to a high degree of business – the average client in that report kept the same advisor for 10.7 years. Maintaining trust and transparency through an honest assessment of the advisor/client relationship will become even more important after the $68 trillion Great Wealth Transfer from baby boomers to millennials. Studies tell us that more than 80 percent of these millennial heirs will seek out a new advisor. Qualtrics also tells us that millennials are less inclined than their boomer parents to keep and recommend to friends a choice of advisor (40 percent of millennials vs. 63 percent of high-net-worth clients would recommend their current advisor to friends).

“Knowing your clients is the most important aspect to providing them guidance,” advises Ryan S. Belanger, Certified Financial Planner™ and managing principal for Claro Advisors in Boston. “I think we are seeing positive change. The internet gives investors many resources and information that wasn't available even 15 or 20 years ago. With that comes better efficiencies, pricing and transparency. Transparency is the key in my opinion.”

“Knowing your clients is the most important aspect to providing them guidance,” advises Ryan S. Belanger, Certified Financial Planner™ and managing principal for Claro Advisors in Boston. “I think we are seeing positive change. The internet gives investors many resources and information that wasn't available even 15 or 20 years ago. With that comes better efficiencies, pricing and transparency. Transparency is the key in my opinion.”

The internet also offers opportunities for do-it-yourself investing that were not available in previous generations. The market for digital investment platforms doubled between the years of 2013 and 2017 from approximately $325 billion to $650 billion globally. This doesn’t mean that investors should take the bait. Investopedia reports that 75 percent of retail CFD accounts on “social trading” platform eToro lose money. It does mean that only the advisors who make a point of helping to educate and relate to their prospects will grow their businesses in the next decade.

“Client education is key. Finances can be complicated, and each person’s situation is different. The best course of action differs for each person, which is why having an advisor who can develop a customized plan is critical to optimizing an individual’s financial picture,” says Stevie Green, MBA, AIF® of Spencer Financial, Inc. “Individuals who are more financially literate are able to do more with the funds they have.”

Of primary importance to a client is the understanding of what a fiduciary truly is. Although fiduciaries have a greater legal responsibility to the client than non-fiduciary brokers, picking a fiduciary advisor does not necessarily guarantee the best financial advice. The term fiduciary means different things to different people, and advising a client towards a loss does not automatically mean that a fiduciary can be sued for malpractice, for instance. Investors should not only ask about the fiduciary status of an advisor, but also what that term means to the advisor.

“Some people may believe that because legally RIAs are held out as fiduciaries, they are the superior choice to brokers and brokers are ‘bad’ due to an inherent conflict of interest of being paid a commission linked to a product. However, this only serves the RIA case from a marketing standpoint, which could be problematic for the end client,” Michael R. Gold, CFP®, MBA and president & CEO of Gold Family Wealth, LLC tells us. “Imagine – would you ever want to use a doctor that does not have access to every possible solution to help you? Of course not. There are certain financial solutions that require professional advisors to maintain certain brokerage licenses, and I don’t know about you, but I want to work with people who have access to every arrow in their quiver. It is important to recognize that there are many great wealth advisors who are ‘brokers’ or ‘dually registered’ and/or ‘investment advisor only.’”

“Some people may believe that because legally RIAs are held out as fiduciaries, they are the superior choice to brokers and brokers are ‘bad’ due to an inherent conflict of interest of being paid a commission linked to a product. However, this only serves the RIA case from a marketing standpoint, which could be problematic for the end client,” Michael R. Gold, CFP®, MBA and president & CEO of Gold Family Wealth, LLC tells us. “Imagine – would you ever want to use a doctor that does not have access to every possible solution to help you? Of course not. There are certain financial solutions that require professional advisors to maintain certain brokerage licenses, and I don’t know about you, but I want to work with people who have access to every arrow in their quiver. It is important to recognize that there are many great wealth advisors who are ‘brokers’ or ‘dually registered’ and/or ‘investment advisor only.’”

In short, the title of the advisor will never compensate for a lack of client education. Savvy advisors are ahead of the curve on this. They realize that leaving clients in the dark about financials or financial professionals will never lead to an optimal outcome for either party. This is especially true in an age when professional malfeasance is easier than ever to ferret out, and when more advisors than ever have been cited for abuses (7.3% of advisors in the US according to Forbes).

“My experience is that you can’t overeducate the client. I sometimes spend an hour explaining the different asset classes that make up their portfolio,” says Kevin Brosious, MBA, CFP, CPA/PFS, CGMA, at Wealth Management 1. Also, I get a lot of clients that tell me that they haven’t heard from their ‘planner’ in years. Not very conducive to a good client experience. I’ve also had clients that asked me ‘can you tell me what I bought?’”

Regardless of title, the best advisors always hold a personal fiduciary responsibility to their clients. Without this internal compass and a dedication to a philosophy of education, no title can hold an advisor to an acceptable standard nor protect an investor from bad financial choices.

1. ^ https://www.bcg.com/publications/2019/global-asset-management-will-these-20s-roar.aspx