Are advisors and investors prepared?

America’s aging advisor workforce poses a challenge for investors and soon-to-be retirees who need a trusted, stable financial manager to guide them through retirement. With many advisors nearing retirement, prospective clients need to start asking about succession plans.

“I would recommend asking about the professional’s depth of staff and the current succession plan within the firm,” said Patrick G. Renn, CFP®, registered principal at the Atlanta-based Renn Wealth Management Group, Inc. “Continuity of relationship is important and evidence of a succession plan is necessary to accomplish this … I would also ask about the professional’s financial planning process and investment process and the client service and communication plan. If these are vague, it may show a lack of a system.”

“I would recommend asking about the professional’s depth of staff and the current succession plan within the firm,” said Patrick G. Renn, CFP®, registered principal at the Atlanta-based Renn Wealth Management Group, Inc. “Continuity of relationship is important and evidence of a succession plan is necessary to accomplish this … I would also ask about the professional’s financial planning process and investment process and the client service and communication plan. If these are vague, it may show a lack of a system.”

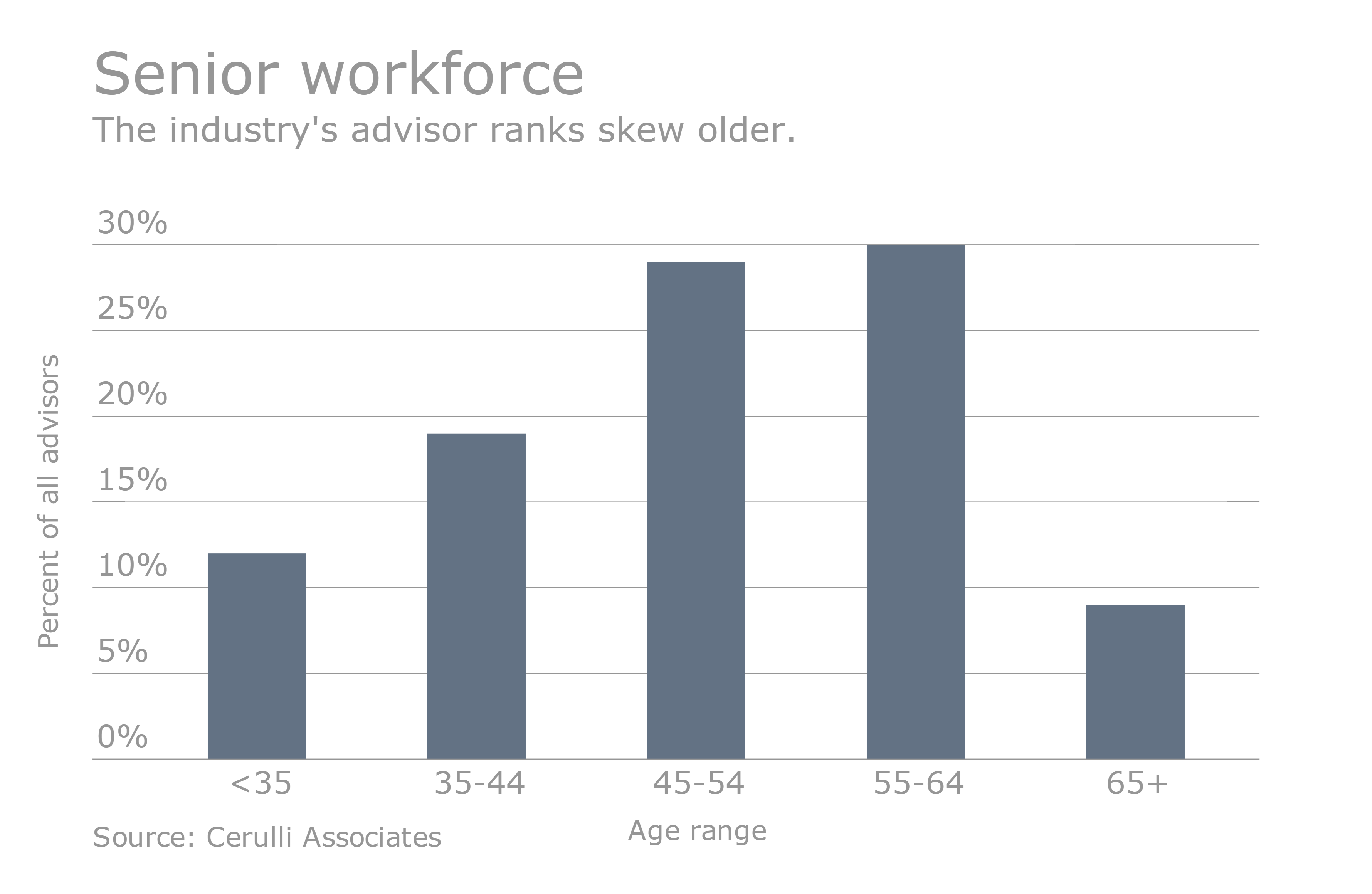

The average age of a financial advisor hovers around 51, with 38 percent of the advisor workforce expecting to retire in the next 10 years, a study by Cerulli Associates found. And fewer than 10 percent of advisors are under 35, the same study reported. Furthermore, nearly a third of advisors fall into the 55 to 64 age range, and their possible retirements can hang over clients and create uncertainty.

Altogether, more than $2.3 trillion in assets are managed by advisors 60 and older. Renn, also the author of Finding Your Money’s Greater Purpose, encourages clients to ask for a succession plan, but investors might not know what a good one looks like.

The key is communication. If an advisor is nearing retirement age and has yet to tell clients the plan, that could be a sign that it is time to start looking for alternatives. An advisor who treats their retirement like anyone else’s – as in, one day they stop going to work and the world moves on – and fails to properly prepare clients to transition to another wealth manager can leave investors with nowhere to go. The investors then need to scramble to find a new advisor and speed becomes more important than fit.

Younger investors – primarily millennials – also struggle to find an advisor who understands them. With so few millennial advisors coming up through the industry, it can be difficult for these investors to connect. Industry watchers have recommended that older, soon-to-be retired advisors begin preparing millennial successors, but progress comes slowly and the generational gap in attitudes toward financial management complicates matters.

“Cultivating a great culture requires a variety of perspectives including varying ages of leadership and staff. Each generation presents its own benefits and risks to an office,” said Michelle Brennan Hall CDFA®, CAP®, president of Brennan Wealth Advisors, LLC, based in Frisco, Texas. “Older generations add wisdom and experience while younger generations bring energy and newness to work. Young career builders can be impulsive with their ideas and may need professional refinement, but the aging advisor demographic may work less, be resistant to change, and may not be inclined to make necessary tech upgrades to safeguard data or engage with clients. As with all good work environments, striking a balance between wisdom and youth is best for culture and clients. In the end, the prudent focus must be on investor protection.”

“Cultivating a great culture requires a variety of perspectives including varying ages of leadership and staff. Each generation presents its own benefits and risks to an office,” said Michelle Brennan Hall CDFA®, CAP®, president of Brennan Wealth Advisors, LLC, based in Frisco, Texas. “Older generations add wisdom and experience while younger generations bring energy and newness to work. Young career builders can be impulsive with their ideas and may need professional refinement, but the aging advisor demographic may work less, be resistant to change, and may not be inclined to make necessary tech upgrades to safeguard data or engage with clients. As with all good work environments, striking a balance between wisdom and youth is best for culture and clients. In the end, the prudent focus must be on investor protection.”

Financial advisors often debate the different generations’ merits. Over the past 10 years Advisors Magazine has interviewed dozens of financial professionals on their thoughts toward the up-and-coming generation of wealth managers, and what will happen to the industry as baby boomers age out. Millennials have been hesitant to enter the financial profession, which some academics and industry hands chalk up to millennials’ experiences during the 2008 financial crisis. At the same time, new technologies and younger generations, including Generation Z, the group behind millennials, embracing more “do-it-yourself” attitudes towards finance all put increased pressure on the industry.

“From what I have read and seen in our industry; the average age of the financial advisor is above 50. Financial advisors under 40 are only 22 percent of all advisors,” said Stoyan Panayotov, CFA, the founder and chief executive officer of Babylon Wealth Management in California. “Given that the millennials are now the largest generation, there are not enough advisors in their age group to meet the demand for financial advice. We see that this void is being filled by robo-advisors and various fintech companies.”

“From what I have read and seen in our industry; the average age of the financial advisor is above 50. Financial advisors under 40 are only 22 percent of all advisors,” said Stoyan Panayotov, CFA, the founder and chief executive officer of Babylon Wealth Management in California. “Given that the millennials are now the largest generation, there are not enough advisors in their age group to meet the demand for financial advice. We see that this void is being filled by robo-advisors and various fintech companies.”

“On that note, young advisors are more open to embrace technology in their practice,” Panayotov added. “They are comfortable using social media, video chatting, blogging, podcasts to communicate with their clients and prospects. Also, younger advisors tend to use more ETFs and passive investing over actively managed mutual funds and stock picking strategies. There is also a small trend of moving away from commissions and assets under management fees to a subscription-based model and on-demand hourly fees.”

Older advisors also express concerns that millennial advisors, and the generations behind them, for now, have only experienced a very narrow set of market conditions. Most millennials watched their parents struggle through the 2008 crisis, but the unprecedented boom following has left them with a warped view of how fast the market can turn.

“There is definitely a difference and part of the difference is that I think older advisors have been paying attention and learning along the way. I think experience comes from not just being somewhere and doing something but paying attention to what you’re doing along the way,” said Roger S. Green, MSFS, CFP®, president and chief executive officer of Green Financial Resources, LLC, based in Duluth, Georgia.

“There is definitely a difference and part of the difference is that I think older advisors have been paying attention and learning along the way. I think experience comes from not just being somewhere and doing something but paying attention to what you’re doing along the way,” said Roger S. Green, MSFS, CFP®, president and chief executive officer of Green Financial Resources, LLC, based in Duluth, Georgia.

“But to the extent that someone has been mature and going through these various stages of the 80s, the 90s, the 2000s, the 2010s, they’re dramatically different periods. For instance, in the 2000s, a large company of U.S. stocks and technology stocks lost money. And yet, in 2010 to 2019, they’ve been going gang busters. Even from 2009, at the market’s lowest point during the Great Recession.”

Millennial advisors who entered the industry during the boom years may be caught off guard when the next recession hits.

“If someone came in 2009, the only thing they’ve seen is the U.S. large cap and indexes go up and they haven’t seen the 10 years prior to that, where they went down, while other assets like value stocks or small company or mid-size or emerging markets or international stocks went up,” Green said. “So, they had this one period of analysis that really probably influences their asset allocation and has them put more money in the areas that have been doing well recently. They will be biased to have an impaired portfolio in the next period, because generally speaking, the same investments don’t just perennially do best. Every dog has its day, and there’s a season for everything.”

“If someone came in 2009, the only thing they’ve seen is the U.S. large cap and indexes go up and they haven’t seen the 10 years prior to that, where they went down, while other assets like value stocks or small company or mid-size or emerging markets or international stocks went up,” Green said. “So, they had this one period of analysis that really probably influences their asset allocation and has them put more money in the areas that have been doing well recently. They will be biased to have an impaired portfolio in the next period, because generally speaking, the same investments don’t just perennially do best. Every dog has its day, and there’s a season for everything.”

Green added that it takes roughly two decades of market watching to really understand the economy’s ebb and flow.

Other experienced advisors, meanwhile, find that the generational differences are not as great as some think, and emerging trends impact investor’s behavior.

“There are new investment vehicles coming out on a daily basis, the economy is ever-changing, the tax laws and healthcare laws are always at risk of change with new political parties,” said Deanna LaRue president of TimeWise Financial, LLC, in Woodstock, Georgia.

“There are new investment vehicles coming out on a daily basis, the economy is ever-changing, the tax laws and healthcare laws are always at risk of change with new political parties,” said Deanna LaRue president of TimeWise Financial, LLC, in Woodstock, Georgia.

“I don’t feel that an advisor can continue to be successful if they are stuck in their way of doing things and not willing to evolve,” LaRue said. “It doesn’t matter the age of the advisor, what matters is their drive to continue to educate themselves on our current environment. This often takes time to travel to conferences, money to pay for that travel, and discipline to do the research. I feel that when we work together as a group, we all benefit from each other’s strengths, knowledge, and experience.”

Advance preparation is key to advisor succession planning. Whether an advisor is young or old, the investors need to know where their financial planner will be in five years, who will take over if something happens, and how changes inside the firm can affect their money. For advisors retiring from established firms, a transition plan needs to be set up or the company could lose assets under management as clients turn elsewhere; advisors considering shutting down their own firm might want to explore selling it instead.

Selling a business can be complicated, however, and the parties involved often will require guidance.

“Buying a business is a complicated process,” said Andy Cagnetta, CEO, Transworld Business Advisors, LLC, based in Fort Lauderdale. The firm helps prospective business owners buy or franchise. “Most of the challenges come from the parties to the transaction being uneducated in this process. That is why we strive to help everyone that wants to buy or sell a business understand the ins and outs of getting deals done.”

“Buying a business is a complicated process,” said Andy Cagnetta, CEO, Transworld Business Advisors, LLC, based in Fort Lauderdale. The firm helps prospective business owners buy or franchise. “Most of the challenges come from the parties to the transaction being uneducated in this process. That is why we strive to help everyone that wants to buy or sell a business understand the ins and outs of getting deals done.”

Investors need to get started right away on learning their advisor’s succession plan. Part of that, of course, means choosing the right advisor, young or old, from the get-go.

“There is a delicate balance when a client chooses a financial professional, being mindful of appropriate experience and education – not too young. Relevance with current trends and technology – not too old,” said Bryan P. Hopkins, CPA, CFP®, founder of Hopkins Wealth Management Group, based in Anaheim Hills, California. “And making sure the advisor’s education, experience and credentials match the needs of the client.”

“There is a delicate balance when a client chooses a financial professional, being mindful of appropriate experience and education – not too young. Relevance with current trends and technology – not too old,” said Bryan P. Hopkins, CPA, CFP®, founder of Hopkins Wealth Management Group, based in Anaheim Hills, California. “And making sure the advisor’s education, experience and credentials match the needs of the client.”