Plain, Simple, and Straight Talk

Many Americans nowadays take part in some form of community service. The career-expert website Zippia.com, in fact, estimates that there are nearly 122,000 community service volunteers working in the United States, based on U.S. Bureau of Labor Statistics and Census data.

Meet Mike Perros, founder of Encompass Financial Advisors who took community service to the nth degree. He’s also Mayor of Danville, Kentucky—having served nearly eight years with fewer than six months to go.

“After my term as mayor, that will end 40 years of some form of public service,” Perros told Advisors Magazine in a recent interview. “I think I’ve served my time, but I encourage others to give of their time and their intellect.”

He emphasized that involvement is crucial and there’s a need for good citizens to serve on school boards, city councils and other civic organizations.

“People need to get involved at such levels, but many don’t,” Perros added. “They need to think hard about the sacrifices made by their parents to make things better for their children and communities.”

In the heart of the Bluegrass State, Danville’s population is about 17,000, and in years past has been ranked as one of America’s best places to retire—a perfect location for a financial advisory practice. Kentucky, in fact, is considered a tax-friendly retirement state.

“Kentucky is wonderful and beautiful,” Perros beamed. “It’s a state of 4.5 million people, which is one-fourth the size of New York City. Many of its communities, like mine, are tightly knit.”

As such, clients of Encompass Financial Advisors do not have to invest a minimum amount in a portfolio.

“I’ve been told by mentors and coaches that I should have a firm minimum, but I cannot bring myself to do that,” Perros said. “Living in a smaller part of the country, word gets around fast. And if you’ve done right by somebody, you’ll get referrals. But the opposite can also happen.”

Perros says he became a financial professional by accident. He graduated in 1981 from the University of Kentucky after majoring in agriculture and minoring in agriculture economics.

“It boiled down to my fraternity (Delta Tau Delta) experience, which opened up the doors for me and I was smart enough to walk through them,” he said.

Immediately after graduation from UK, Perros worked full time as a Delta Tau Delta chapter consultant. His national focus, involving visits to more than 40 chapters in a single year, led to a broader perspective that still serves him well.

He’s also a graduate of the Securities Industry Institute, a three-year program held at the Wharton School on the campus of the University of Pennsylvania. Perros also completed a complex six-month curriculum accredited by the Estate and Wealth Strategies Institute of Michigan State University. The advanced courses covered financial planning, estate planning, risk management, and other wealth management strategies.

For almost 30 years he worked with several full-service firms who paid their financial advisors based on commissions.

“In 2013 I dedicated myself and made a conscious effort to become a registered investment advisor (RIA),” Perros said. “That was a result of a decision I really made back in 2000,” he recalled, “when I was sitting with a fellow much more successful than me who was an RIA and he explained to me how he conducted his business.”

Perros knew then that an RIA was the way to go. “I saw it as the avenue for much of the industry because RIAs are fee-only and have a fiduciary responsibility to act in their clients’’ best interests. I saw it was a much more holistic way of doing business,” he said. Today, Encompass Financial Advisors is a division of Resurgent Financial Advisors LLC.

Keeping it plain, simple, comfortable

Perros maintains that education is vital to his business. “The more educated your client is, the more comfortable they are,” he said.

“I find that the more you inundate clients with the numbers and the charts and all that, the more you lose them,” Perros said. “Besides, it’s really not all about the numbers as much as it is setting a course based on the client’s individual situation and goals and fears and dreams.”

Education can also be a two-way street. He noted that working with clients to define their goals and dreams is essential. Equally important though is to understand each client’s tolerance for risk. Investment plans need to incorporate client goals and client risk profiles. Both elements should be monitored and updated accordingly throughout the course of the client’s life.

“Sometimes things change in a client’s situation, and you need to just listen,” Perros said, “and make portfolio adjustments accordingly, if warranted.”

Over the years, Perros has consistently emphasized to clients the need to stay focused on their plan and how their plan will help them in the future.  “As a result, during times like now, the phone calls I get are not ones of panic,” Perros said. “Client calls are more typically asking, ‘hey, am I still where I need to be?’ And the answer most all the time is yes – unless they have certain situations that occur in their life – a health issue, a major career change, a change in their domestic situation.”

“As a result, during times like now, the phone calls I get are not ones of panic,” Perros said. “Client calls are more typically asking, ‘hey, am I still where I need to be?’ And the answer most all the time is yes – unless they have certain situations that occur in their life – a health issue, a major career change, a change in their domestic situation.”

In keeping it all simple, Perros maintains that there are just two types of investments.

“There’s debt and there’s equity. Everything else is just a derivative of those two things,” he said. “And I choose to keep it that plain and simple.

Regarding developing customized plans and solutions for his clients, Perros reiterated that it all starts with listening to the client’s hopes, dreams and even fears.

“It’s easy on my side to crunch the numbers,” he said. “The hardest part I find is getting clients to develop a future budget. I can’t do that for them. I can ask the questions, but the answers require some long-term thinking on their part and the clients really must engage. I need them to give me a target I need to shoot for. An active and honest dialogue is critical to the process.”

Staying the course

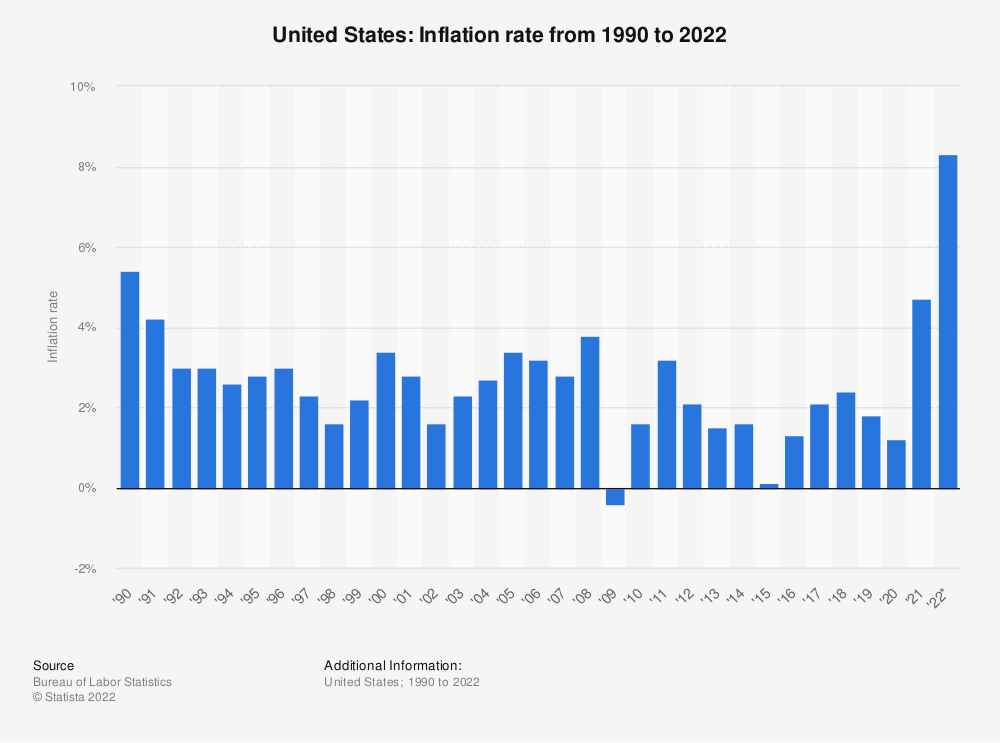

The future, in general, appears cloudy given the current state of the U.S. economy, the impact of inflation and the possibility of a recession.

“I think we have to recognize that we are in an inflationary period and anybody that did not see it coming doesn’t study the economy,” Perros said. “You cannot open the flood gates to easy money for years and not have that come back to bite you. Keep in mind, I got into this business in 1982 and I saw what Mr. (Paul) Volcker did in that inflationary period.”

He added: “It’s the same thing that we’ve got going on now—the Fed raising rates, which is the only tool in their toolbox. But Volcker doing that back then, that broke the back of inflation and we’re probably going to see something very similar.”

And does Perros have any special advice for clients in an inflationary environment?

“In my estimation they should do nothing,” he said. “Some people argue for going to all cash. Well, the problem with that is, if you have a good portfolio and take everything in all cash, you may have just incurred a tax bill. Thus reducing the value of your assets. I don’t see much wisdom in that. Additionally, the implication when one goes to all cash is they know the precise timing to get back into the market. I have yet to see this done successfully. The result is, they miss the markets upward movement if they even invested it back at all.”

Sticking with it also proved especially successful during the pandemic. “Lessons I learned many, many years ago were repeated in 2020-2021, and that is if you have a good portfolio, stay with that,” Perros said. “The negative news does not stay negative forever.”

Nonetheless, Perros doesn’t think today’s inflationary environment is going away any time soon, and that could have a significant impact on those close to, or already into retirement — especially as people are living longer.

“The challenge is to get people to understand that if they start to save at 30 and plan to retire at 65, that’s 35 years of accumulation of assets,” Perros said. “But then they are going to spend the next potentially 30 to 35 years – the same length of time -- it took for them to build up that financial net worth to support themselves.”

And inflation will erode their spending power over those years.

“There is also the fallacy that people won’t need nearly as much money in retirement, that your spending decreases,” Perros said. “That’s pure fallacy, particularly if they want to have any kind of rewards that retirement brings in terms of travel or a vacation home, or whatever.”

He explains that when advisors and clients start running the numbers—looking at whether their assets can support 30 years of spending in retirement—those numbers often simply do not match.

“So, something has to give,” Perros said. “Either people will try to go back to work; they’ve retired too early, or they’ve got to lower their expectations for that 30-year period of retirement. Neither situation is desired,” he added.

Over the course of his 40-year career, however, Perros has observed that those who’ve had comfortable retirements are individuals that had the right percentage invested in equities early on in their careers, stayed in equities, and maintained the right mix of equities and debt securities all through retirement.

For more information, visit: encompassadvising.com