The Evolution of Blue Line Wealth Management

Brentwood, Long Island-based Blue Line Wealth ManagementBlue Line Wealth Management is a niche financial services firm working mostly with law enforcement and their families. However, since its inception, the three-partner practice has expanded its business – by leveraging the talents and experience of two partners in particular – Jeffrey Greco and Sean Carey – to provide full-service advice to municipal and county employees.

“We mainly serve the rank-and-file union members of municipalities and counties,” Greco told Advisors Magazine in a recent interview. “These are hard-working, family people, the backbone of America in many ways,” he added.

For both Greco and Carey, it was natural to gravitate toward a client base typified by having good jobs, steady incomes, and excellent employment benefits. “We both come from families of civil servants and that’s how we understand the lives they’re living because we grew up that way,” Carey said.

Greco joined as a partner shortly after the company’s start, bringing 30 years of experience in the field of financial planning, wealth management, insurance, and retirement planning. He began his career as an independent insurance agent and stockbroker and then became affiliated with American Express.  “I was with AMEX initially as a financial advisor and then as a district manager and field vice president, over some 16 years,” he recalled. But he wanted to be an independent advisor and became the owner of JB Greco and Associates LLC, allowing him to partner up with Blue Line and other firms.

“I was with AMEX initially as a financial advisor and then as a district manager and field vice president, over some 16 years,” he recalled. But he wanted to be an independent advisor and became the owner of JB Greco and Associates LLC, allowing him to partner up with Blue Line and other firms.

“My life’s work has been to help business owner’s, unions, municipalities and professional associations by developing and providing group benefit solutions, pensions, trusts, and insurance products to meet their current and future financial needs,” he said.

He explained that these are clients, for the most part, who live on a household budget, have children, own a home, and are concerned about financing college. “These are the people looking for the most advice,” Greco said, “So, we get into discussing everything from debt planning, saving for college, retirement planning and more.”

As such, it’s not just about portfolios. Greco and Carey are focused on the five pillars of financial planning: income and expenses (cash flow), protection planning (all insurances, employee benefits), tax planning, retirement planning and estate planning.

“Working with clients, we address all five of those,” Greco insists. “We are not just a money management firm.”

He adds: “If you have a sound, comprehensive financial plan, you also need to have discipline and time. And time and discipline are two vital things we tend to discuss with our clients.”

Greco’s areas of specialty are investments, retirement plans, life insurance, group benefits, healthcare consulting and estate planning. Greco’s credentials include Chartered Life Underwriter (CLU), Chartered Financial Consultant (ChFC) Registered Health Underwriter (RHU), Certified in Long Term Care (CLTC), Registered Employee Benefit Consultant (REBC), and Certified Fund Specialist (CFS). He holds Series 7 and 63 licenses and offers financial planning and securities through LPL Financial.

Carey was a senior business consultant at Ernst and Young (EY) responsible for conducting risk assessments for many institutional clients. He is now a partner at Blue Line and holds the Series 7, 63, and 66 licenses with LPL Financial as well as life, accident, and health insurance licenses. In addition to serving municipal and county workers, the firm’s client base also includes educators. “We’re very familiar with the many challenges teachers and staff members face such as lesson planning, childcare and the overall running of a household,” Carey said.

In addition to serving municipal and county workers, the firm’s client base also includes educators. “We’re very familiar with the many challenges teachers and staff members face such as lesson planning, childcare and the overall running of a household,” Carey said.

Similar to the full services available to municipal workers, a customized financial consultation for teachers, for example, might include an in-depth review, pension analysis, 403(b) planning, Roth and traditional IRAs, tax-managed accounts, estate planning, life insurance, and full step-by-step assistance with 403(b) account opening paperwork completion and submission.

Carey, meanwhile, can especially relate to a younger generation of first-time investors, which is another area of growth for the firm.

“We take pride in educating the younger generation on the powerful benefits of compound interest and the importance of getting started early with a dynamic financial strategy,” he said.

To help young investors get started on their financial journey, Blue Line offers, for example:

• No required minimum investment

• Personalized investment plans based on individual risk tolerance

• A mobile app for real-time monitoring of account performance

• Lifelong financial planning assistance

Blue Line’s third partner is Scott Frayler, who founded the firm to provide specialized financial services to those working in law enforcement. That remains a central piece of Blue Line Wealth Management’s business, as the name still implies. Greco and Carey, however, have widened that original niche to effectively include all other -- non-police -- municipal and county workers.

The three partners all provide financial planning and securities through LPL Financial, and the Blue Line Wealth Management website includes the latest research reports, podcasts and other market thought leadership from LPL.

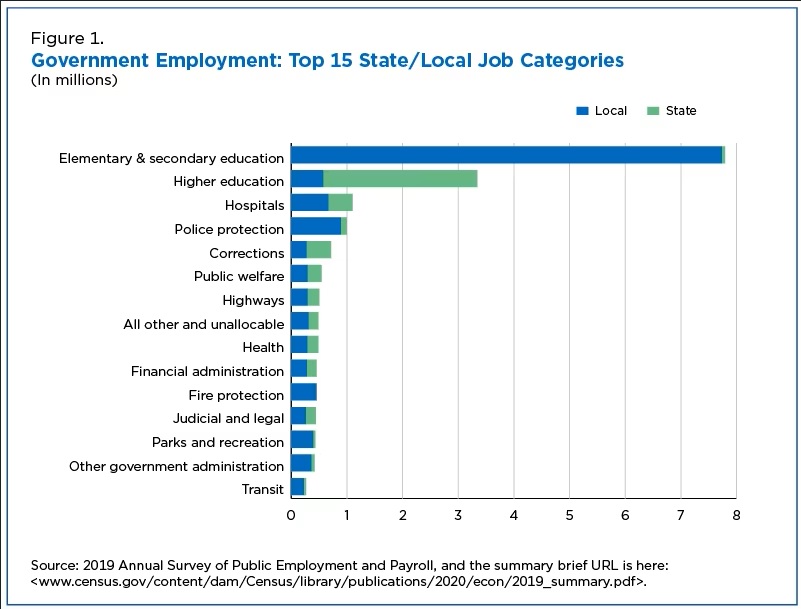

According to the United States Census Bureau Annual Survey of Public Employment & Payroll (ASPEP), education and police protection consistently rank among the top four job categories across the nation. But other municipal and local employment categories—from fire protection to highway/infrastructure workers, to county parks and recreation personnel and more, all share a bond for uniquely tailored financial services.

Workers in such roles also tend to share good experiences with colleagues -- and referrals are fueling Blue Line’s ever-growing client base. “It’s imperative to always do the right thing for our clients,” Greco emphasizes.

For example, when it comes to retirement planning and more, Greco says the firm helps clients “understand what it is they need to do to get to the point where they want to be.” Carey adds: “Whatever their goals, we help them get there, managing expectations as we work to make it all happen.” Greco says that usually means some adjusting along the way. “And that’s when and where the discussions take place around what’s realistic and doable—always with the client’s primary goals in mind.”

For more information on Blue Line Wealth Management, visit: bluelinewealthmanagement.com

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state. Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.