Three Tips from Advisors

Record-high inflation rates and the potential menace of recession has left Americans feeling increased economic-related stress.

The Stress in America survey conducted in March by the American Psychological Association and the American Institute of Stress documented that 87 percent of Americans indicated the “rise in prices of everyday items due to inflation” is a significant source of stress. The uncertainty regarding whether the country is already in, or headed to, a recession adds to the anxiety regarding economic security.

Everyday Americans are not the only people that admit they believe the economy may experience further struggles in 2022.

Nine out of ten traders “see” a U.S. economic recession as “somewhat to highly likely” and 74 percent anticipate it will begin this year, according to the latest Charles Schwab Trader Sentiment Survey released for the third quarter 2022. Even more telling is that within the survey, the percent of traders identifying recession as a “primary concern” tripled in the third quarter at 18 percent versus only six percent in the second quarter.

This isn’t the best news for Americans who are getting burned out dealing with economic troubles. However, there are steps to take to help improve one’s odds against inflation and recession.

Advisors Magazine talked to three financial advisors and here are their suggested actions:

Buy Real Estate

It’s too late to use real estate to hedge against today’s inflation. But perhaps not for tomorrow’s potential inflation. Real estate – and the mortgage most people need to own real estate – has a winning relationship with inflation. For the most part, the purchase price of real estate rises. Of course, there are exceptions – think of the 2008 housing bubble. But again, for the most part, the purchase price of real estate rises.

Here is where the mortgage loan – and monthly payments – work together to create a tool to beat inflation: it’s called equity. Each payment lowers the loan-to-value of a loan debt. The homebuyer gains economic value in the property, but their monthly payment is staying the same.

Ryan Fleischer, CEO, CIO and founder of Revolution Group in Omaha, Nebraska, uses this economic principle in his effort to hedge his clients monies against inflation.

Noting that his firm did not believe inflation was transitory in 2020 and 2021, Fleischer said, “We increased our positioning to commodities and real estate assets, especially private real estate and infrastructure.”

The strategy worked, he said.

“I don’t believe we will have a recession this year, but we see storm clouds on the horizon and expect a considerable slowdown starting next year,” said Fleischer. “Our member will be well-prepared and well-positioned.”

Don’t Freak Out

Easier said than done, but here is where the discipline of keeping emotions out of financial decision-making wins against inflation and recession.

“No need to panic,” said Richard Siegel, managing partner of ARQ Wealth Advisors, LLC, located in Scottsdale, Arizona. “Recessions are a normal part of the economic cycle.”

Siegel said he and the members of his firm feel that the next recession should be short and shallow based on a strong labor market and a strong consumer.

Since 1900, the United States has experienced numerous recessions, including the Great Depression that began in 1929 and officially ended1939. Brief recessions with no long-term impact on the economy occurred in 1949, 1959, 1953, 1958, 1961 and 1961, according to an article on the history of recession at www.bebusinessed.com. Between 1973 and 1975, the United States experienced a stagflation due to the combination of Vietnam War spending, rising unemployment, and increasing oil prices from overseas providers. A six-month recession marked 1980. Three more short recessions in 1981, 1991 and 2001 occurred. Then the Great Recession from 2007 to 2009 coincided with the burst of the housing bubble.

The good news is that the U.S. economy recovers post-recession. Sometimes quickly, sometimes slowly, but growth and recovery do return. So, recession too shall pass. No need to panic.

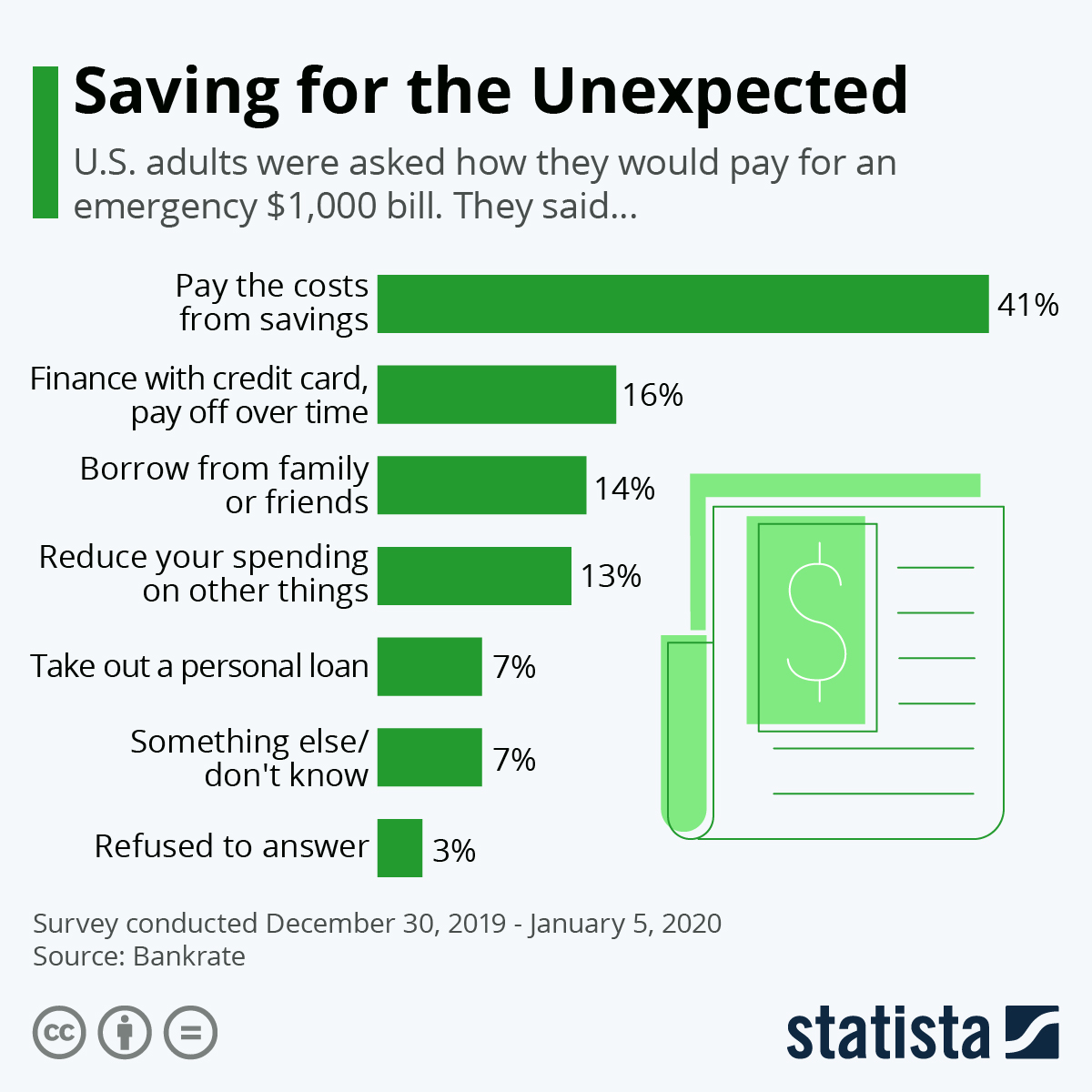

Pad Your Cash Account

This is a twist on the advice to have three months cash on hand when quitting a job.

“One thing we are advising clients to do is make sure that they have a credit line available to the business, as well as six months’ worth of operating cash if possible,” said David Clayman, CEO and wealth advisor with Twelve Points Wealth Management in Concord, Massachusetts. “This line will protect them in the event that the U.S. economy enters into recession, and they need to cut expenditures to make it through to the other side.”

Other financial advisors suggest the same six months of cash on hand. Some suggest more depending on the number of breadwinners within the household.

Anna N’Jie-Konte, founder of Dare to Dream Financial Planning, told Business Insider that she recommends single-income households aim for six to nine months of cash in reserve.

Amy Arnott, a portfolio strategist with Morningstar, echoes the six months target. She adds an additional slant.

“While cash isn’t a growth asset, it will usually keep up with inflation in nominal terms if inflation is accompanied by rising short-term interest rates,” Arnott also told Business Insider.

Interestingly enough to Arnott’s point, the Federal Reserve has raised interest rates several times in 2022 with additional increases expected in 2023.

So, if possible, a six-month cash reserve seems to be a prudent move.

Wrapping It Up

It is fair to say that inflation and possibility of a recession following on the coattails of the COVID-19 shutdowns has taken the air out of the economic sails of many Americans.

But we do have the choice to make lemonade out of the lemons. Investing in real estate for the long haul, avoiding panic, and opting to boost cash holdings are all actions each person and business owner can make – even if only in small increments – to decrease the negative impacts.

What efforts are you taking to combat inflation and recession? We’d enjoy reading your comments. Email us at This email address is being protected from spambots. You need JavaScript enabled to view it..