Since its founding in 1916 The Conference Board has been a member-driven think tank — as well as a non-partisan, and a not-for-profit entity. Its mission has been steadfast: to provide trusted insights to help its members anticipate what’s ahead, improve corporate performance and better serve society.

The Conference Board was established by executives and U.S. business leaders “during a prolonged period of economic turmoil,” as noted in its historic timeline.

Turmoil might be too strong a word to describe the current economic environment. But from Main Street to Wall Street, there is plenty of uncertainty, nervousness about a recession, and concern about inflation, supply-chain issues, interest rates and more.

Helping to make sense of it all – as she has done for CNBC, FOX Business, Bloomberg, Thomson-Reuters, CNN Finance, Yahoo Finance, TD Ameritrade, Barron’s, the Financial Times, and the Wall Street Journal—is Dana Peterson, Chief Economist & Center Leader of Economy, Strategy & Finance at The Conference Board.

“In economics, a lot of things are repetitive; it just comes in a different package, but it’s the same thing,” Peterson told Advisors Magazine during a mid-June interview. “And those who understand such history, they’re oftentimes the better economist. So, if you meet an economist who’s 80 or 90 years old,” she laughed, “listen to them, because he or she lived through something.”

Peterson is nowhere near that age range, but her experience is deep. She joined The Conference Board in September 2020—at the height of the pandemic and its attendant global economic upheaval. She had been with Citi, where for many years she served as a North America Economist and later as a Global Economist. Her wealth of experience extends to the public sector, having also worked at the Federal Reserve Board in Washington, D.C.

The day Advisors Magazine spoke with Peterson was the day the U.S. Federal Reserve raised its target federal funds rate by 0.75% in an effort to rein in inflation. The Federal Reserve had said that it is prepared to push the economy into recession to confront inflation if absolutely necessary, believing that “soft” or “softish” landing is achievable, according to The Conference Board.

“It was a big move, not seen in some 30 years” she explained, “but what I think was also quite striking is the fact that the Fed indicated it’s willing to raise interest rates to 4% over the next 18 months.”

Peterson came away with two interpretations of the move. The first is that nearly 4% is indeed the goal.

“The other is that maybe it’s a shock-and-awe situation where you put the idea of 4% out there, everyone responds to it, and you achieve your goal sooner than you expected,” she said. “So, you don’t have to really go all the way there.”

The goal of the rate hikes is to bring inflation back down towards a 2% target, which carries the risk of a recession.

“If the Fed does increase the funds rate to 3-3.5% this year,” Peterson explained, “we could potentially have a period of recession -- defined as negative GDP, but also higher unemployment and strains and stresses across a number of industries.”

But if the Fed’s rate does increase to 3.5-4% to try to tame inflation, is it a given that a recession can be avoided, or at least mild?

It’s tricky because inflation has demand-side drivers and supply-side drivers. Peterson said the Fed’s policies can only affect the demand side, not the supply side.

Dampening demand-side inflation drivers

On the demand side, Peterson points to the fact that the U.S. is nearly at full employment. “Most people are working and they’re also seeing their wages increase,” she said. “You also have very strong demand for housing and that was fueled by mortgage rates reaching very low levels over the pandemic period.”

Many people, she observed, have savings—some of which was generated by the pandemic’s fiscal stimulus from last year.

“People spent some of it, some paid down bills with some of it, and then socked away some of it in banking accounts and wherever,” Peterson explained. “So, you have all these things with the potential to drive demand to buy goods and services and houses, all of which is influencing inflation.”

She noted: “Consumers, even though they’re complaining about inflation, they’ve continued to spend.” Peterson maintained that the retail report, released June 15, wasn’t great, but good. “Plus, it doesn’t reflect all the services people are buying and during the pandemic, people bought more goods than services.”

She suspects people are probably shifting away from buying goods. “You know, a consumer is maybe not interested in buying two or three cars or five or six lawn mowers, but they are considering going out again and on vacation. Services, right?” she reasoned.

“So maybe you’re going to spend on those baseball tickets or going back to the movies, those kinds of things,” Peterson said, “but none of that’s reflected in the retail sales report. The only thing in the retail sales report are restaurants and people went to restaurants—they spent money on that last month (May).”

Peterson explained, “With the Fed raising interest rates, all of a sudden it becomes much more difficult to buy a house because the mortgage rates are going to rise, and maybe you don’t want to pay that higher rate. Or maybe you won’t buy a car because you now don’t want to finance it.”

And then, once there are signs of growth rates slowing, many people may start to feel threatened with the possibility of not having a job soon, so they pull back on spending.

“Likewise, if you’re a business, all of a sudden it’s more expensive for you to borrow money,” she added. “And also, a business might start thinking, ‘you know, the economy’s slower, so maybe we won’t hire as many people,’ or in some cases they may even let people go.”

Of course, as demand cools, prices come down.

“The problem is that you also have these supply drivers that the Fed can’t do anything about.” Peterson said.

Supply-side concerns

“The war in Ukraine is raising prices for commodities globally,” Peterson said. “We’re feeling that here in the U.S. even though the war’s on the other side of the world. It’s raising prices for food, gasoline, metals, and even computer chips that go into just about everything we use—all those prices are rising, and the Fed can’t stop that.”

What’s more, global supply chain disruptions remain.

“Some of it’s linked to the war,” Peterson said. “Some of it’s also linked to semiconductor shortages, and a lot of it is also linked to the fact that China has a zero COVID policy.”

Under China’s zero Covid policy, the Chinese government is quick to shut down entire cities, as it did most recently in Shanghai.

“China’s a huge manufacturing and shipping hub,” Peterson said, “and if you shut everything down with the result being they are not manufacturing or shipping anything, there will be supply-chain disruption.”

A third element of supply is labor shortages in the U.S., acknowledges The Conference Board economist.

“It seems weird to say that we’re having a labor shortage, but we are—and it’s mainly in industries that involve in-person services,” Peterson said.

These would be occupations where a person cannot work remotely, where they physically must go to the workplace to get a paycheck. These would include restaurants, hotels, sporting and events entertainment, and such. Even most manufacturing—although not in the service sector—most people need to physically be on the factory floor. It’s the same with transportation and warehousing.

“These are the areas where you’re seeing these big shortages of workers,” Peterson said. Some of those shortages were caused because a lot of people decided to retire and they’re not coming back to the labor market.”

But Peterson also points to the trend of people in such sectors deciding to quit the jobs where they had to be physically present and starting more flexible or remote work—and perhaps make even more money.

“Wages are rising,” she said. And that’s because businesses are paying more to keep the workers they have, as well as advertising higher salaries to attract new labor.

“So, you have these wages that are rising and that means more money floating around, which means more capacity to spend, which means higher inflation,” Peterson said.

“Those are the kinds of things the Fed doesn’t have the power to deal with it,” she added.

No doubt, it’s a difficult tightrope act for the Fed. There are things happening elsewhere in the world beyond its control.

“And while the labor shortage in the U.S. is a domestic issue, the Fed can’t necessarily get people to go back to work, nor force people to work in a particular industry,” Peterson said. “So, on the demand side the Fed can hike interest rates to 4% if they want to, but you could still have these outside, or supply-side forces that continue driving inflation higher,” she said. “And that makes it very difficult for the Fed.”

Recession and Stagflation

A possible outcome is a period of stagflation in the U.S.

The official and latest Conference Board economic outlook, is that it does foresee a brief but shallow recession starting in the final quarter of 2022 and into the first quarter of 2023.

“We now expect a recession given the Fed’s more hawkish policy stance as well as periods of stagflation both before and after the recession,” it said in its latest report (June 21).

Stagflation is described as a period of very low growth and high inflation.

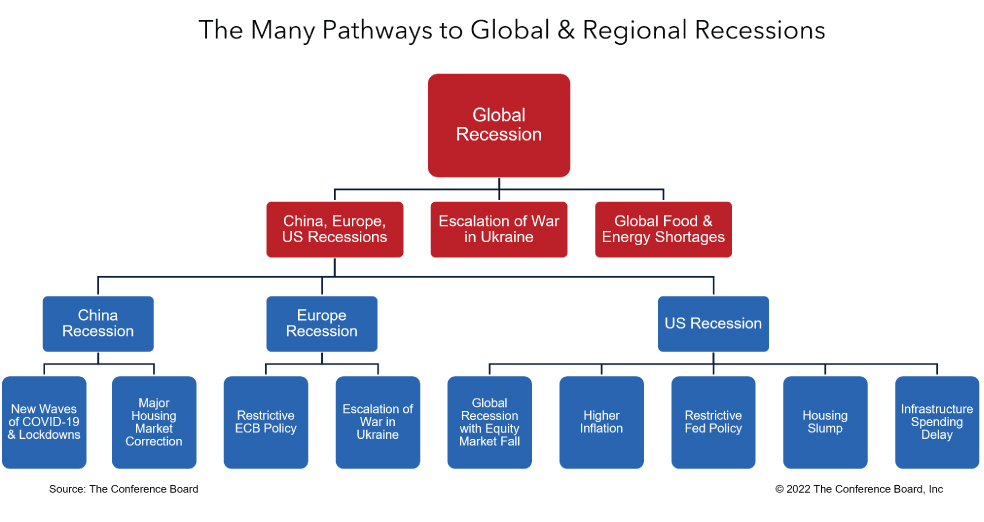

“There are also other downside risks to this outlook that could make the recession longer and/or deeper,” The Conference Board noted citing the top risks as:

1. economic weakness outside of the US hurting the domestic economy

2. inflation rising higher than currently forecast,

3. a sharp correction in US housing prices, and

4. a delay in the deployment of government spending associated with the 2021 infrastructure bill.

She added: “The Fed is expected to raise the federal funds rate to 4 percent by early next year, which includes bigger hikes and faster than economists previously expected. So now, you’re going to see growth dip into negative territory.”

As of this writing, The Conference Board forecasts that US Real GDP growth will rise to 2.1% (quarter-over-quarter, annualized rate) in Q2 2022, vs. -1.5% growth in Q1 2022. Annual growth in 2022 should come in at 2.0% (year-over-year) and growth of 0.6% (year-over-year) is expected in 2023.

“Currently, US economic activity continues to expand despite headwinds from persistent inflation and rising interest rates,” The Conference Board said. “While consumer confidence has cooled, real consumer spending continues to grow. Furthermore, business activity also appears to be holding up despite continued input costs pressures and a tight labor market. Wages continue to rise rapidly, although when adjusted for inflation, consumer purchasing power is declining. Excess savings are helping to bridge the gap.” Generally, a recession is defined as a period of economic decline during which trade and industrial output are reduced, marked by a fall in GDP in two consecutive quarters. Peterson, however, notes that not always the case.

Generally, a recession is defined as a period of economic decline during which trade and industrial output are reduced, marked by a fall in GDP in two consecutive quarters. Peterson, however, notes that not always the case.

And she points to the recession resulting from the pandemic, which wasn’t two successive quarters.

“It’s not about the length, it’s about other things as well,” Peterson explained to Advisors Magazine.

Key considerations are how much economic activity falls and by how much does GDP fall.

“During the pandemic we had seriously negative growth,” Peterson said. “And on top of that, widespread diffusion that negatively affected many industries by what was happening.”

Economists assess how various contributors to economic activity behave, including consumers, businesses, the government and if or how it responds, trade, and more.

“A number of factors determine if an economy is in a recession,” Peterson emphasized. “it’s not a hard and fast rule of just two quarters of negative GDP growth.”

Main Street vs. Wall Street

Peterson received an undergraduate degree in economics from Wesleyan University and a Master of Science degree in Economics from the University of Wisconsin-Madison.

Her sophomore year she took Economics 101 and that was the inspiration for her career—thanks to a great teacher.

Professor Miller, she recalled, was amazing.

“He made all the boys take off their hats and he took attendance,” Peterson smiled. “Such things were foreign in a college setting, you know, but he insisted upon some measure of decorum—so that made him unique and memorable as a person.”

As far as his teaching, Peterson remembers how “he wrote two things on the board that were just so simplistic, which really helped to explain a very complex world.”

Number one: macro-economics is based upon supply and demand—and when those two things are out of balance, you have problems.

“And the second thing was, he said, ‘Macroeconomics is about what, how, and for whom.’ So that all just means what are you making, how are you making it, and who wants it?

He wrote that on the board the very first day of class, just those two things.

“And it turned out that was what the final exam was about--those two questions and a bonus question,” Peterson laughed. “Like literally there were three questions on the final. I remember it being such a very simplistic framework for explaining a very complex world. So that just really turned me onto economics, and I’ve been doing it ever since.”

Among the books that made a profound impression on Peterson: Capitalism in America: A History, by Alan Greenspan and Adrian Wooldridge.

“It was truly fascinating to kind of look at how capitalism has evolved over the centuries,” she said. “And, right now, there’s this big focus on stakeholder capitalism, but it was always there.”

Peterson echoes some of the lessons of that book: You can’t have a corporation without a consumer, someone to buy the good or service; so certainly, the customer matters. And you can’t produce anything unless you have workers who are willing to do the job.

“And you can’t have a corporation without shareholders—so stakeholders have always been there, needing to be considered—especially any public company,” she said.

Turning to financial markets and the economy, Peterson notes that they are not always in sync. Markets tend to be volatile, with higher peaks and lower troughs than GDP, for example.

And while she generally doesn’t give investment advice, she did share some ideas should a recession come about.

“Typically, consider anything that speaks to necessities,” Peterson advised. “Think about the things that people need--food, housing, paper products, toothpaste—things that people always need to use.”

Another area for ‘recession-proof’ investing: consider things that are pervasive, according to Peterson. “For example, like semiconductor chips. They’re in everything and we don’t have enough of them,” she said.

Peterson also noted that even in times of economic woes, people still like to be entertained.

“And they’ve gotten used to streaming, which, costs less than taking a family of four or five to the movie theater and buying popcorn and tickets and everything else,” she observed. “You pay $10 or $20 to stream a movie, whereas that might have been a hundred-dollar trip to the theater.”

In fact, almost anything that is at the vanguard of changes in consumer and business behavior could make good investments in a recessionary environment, Peterson summarized.