A federal commission recently recommended that schools and universities begin requiring financial literacy courses. And advisor Judson H, Gee, CEP, thinks that idea’s time has come.

“People are literally afraid to talk about money because of our educational system,” Gee, managing partner of JHG Financial Advisors LLC in Charlotte, North Carolina told “Advisors Magazine” during a recent interview. “We don’t have economics classes anymore in junior high like in my day. It’s getting worse and worse and I really do blame the education system for why people are feeling overwhelmed by numbers.”  JHG Financial Advisors provides tailored financial planning and wealth management solutions for a broad range of clients. The firm does not require a minimum asset level to sign on as an investor, but rather looks at personal fit and prospects’ motivation to take charge of their financial future.

JHG Financial Advisors provides tailored financial planning and wealth management solutions for a broad range of clients. The firm does not require a minimum asset level to sign on as an investor, but rather looks at personal fit and prospects’ motivation to take charge of their financial future.

The public system does appear to be doing a poor job in financial literacy education. Chaplain College’s Center for Financial Literacy published a state-by-state (including Washington, D.C.) “report card” in 2017 that gave only five states – Alabama, Missouri, Tennessee, Utah, and Virginia – an “A.” Meanwhile, 27 states received a “C” or below. Further, 30 percent of states received grades “D” or “F.”

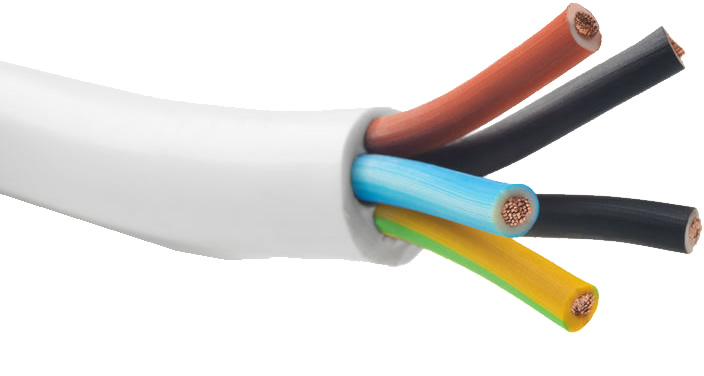

The lack of financial literacy preparation complicates advisors’ outreach efforts. Financial advisors need to get creative in presenting complex investment information and remain patient with clients who need to be taught from an absolute beginner level, Gee said, adding that he often makes television appearances in which he uses relatable concepts to teach finance. One example Gee uses is that of an elevator’s cables.  “A cable is built of many threads, and they do that for strength,” he said. “If one of those threads within the cable breaks, in other words one of [the companies in your portfolio] goes out of business, then you have a hundred other threads in that cable.”

“A cable is built of many threads, and they do that for strength,” he said. “If one of those threads within the cable breaks, in other words one of [the companies in your portfolio] goes out of business, then you have a hundred other threads in that cable.”

Gee’s education process covers everything from college savings to bonds to long-term care planning. At times, he has even met with clients for up to three hours to make sure they understand their financial picture. Developing a customized financial solution that meets the client’s financial goals requires a deep-dive into their options, and how everything works, and constant, effective communication on both sides, he said.

Client education matters more than in previous decades. The financial system continues to become more complex with additional products, alternative investments, and international options all available to today’s investor. But with that increased choice comes a firehose of information that many find difficult to process, Gee said.

“It’s not like it was 26 years ago when I got into this investment world, the business world has become faster and less stable. “Who would have known big blue-chip companies such as GM, First Union or others of that size, would have gone out of business during the financial crisis of 2008, some to be bailed out by government?” he said. “And you can’t do like my grandfather and grandmother did and leave an inheritance with a single stock and that gets passed down from generation to generation.”

For more information see: jhgfinancial.com

Advisory services offered through Chalice Wealth Advisors (CWA) an SEC registered investment adviser. Securities services offered through Chalice Capital Partners. LLC (CCP) member FINRA/SIPC. CWA and CCP are affiliated entities.